Refractories: US-China uncertainty overshadows refractory supply chains at UNITECR 2019

2020-09-09

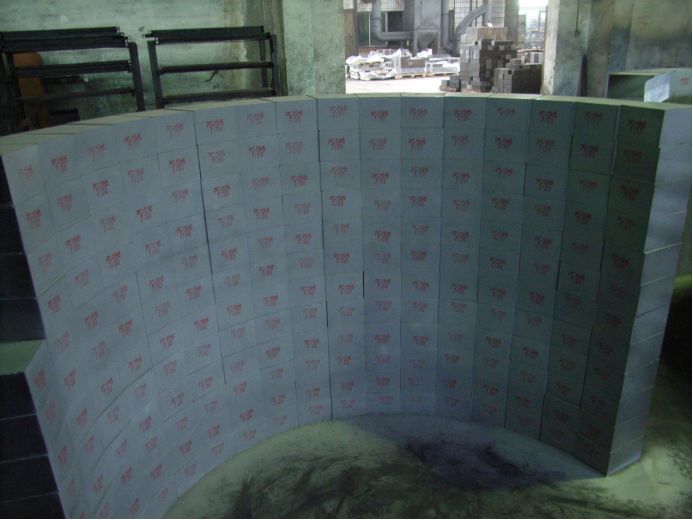

Despite a devastating typhoon, 859 participants from 41 countries gathered this month atUNITECR (the Unified International Technical Conference of Refractories) in Yokohama, Japan – a biennial international conference to discuss current trends in the refractories industry. Delegates discussed how strengthening Chinese environmental regulations, rising Chinese production costs, and high raw material prices continue to have an impact on the world refractories industry. Some of the most important industrial minerals for use in refractories are graphite, alumina and magnesia – which have also been some of the materials most dramatically affected by price rises in recent years. China remains the largest producer of refractories and is expected to account for more than two thirds of a global output of 37.3Mt in 2019. It is also the largest supplier of refractory raw materials for its own consumption as well as for export.

Delegates at the conference reported concerns about the lack of certainty around Chinese plans for next year and even for the next decade. Continued trade tensions between the USA and China are adding to the lack of certainty Chinese delegates are feeling in their domestic markets. US and Chinese negotiators are currently working to complete a text for the agreements for US President Donald Trump and Chinese President Xi Jinping to sign at an Asia-Pacific Economic Cooperation summit in Chile 16th to 17th November 2019, but deep differences in the two countries’ economic models mean their trading relations are likely to be unstable for years to come.

Roskill View

Prices for refractory minerals, including graphite, alumina and magnesia, increased from mid-2017 through 2018 as a result of Chinese production plant closures (as well as rising demand from non-refractory applications – in particular, there was strong growth for graphite in the lithium-ion battery industry). Refractory producers began to increase purchases and build stockpiles to guard against further price rises and the possibility of supply shortages. Price rises slowed though H2 2018 and H1 2019 and in some cases have reversed, but prices for most of the refractory raw materials remain far higher than they were in the mid-2010s.

China is expected to continue its programme of environmental inspections and the closure of plants that fail to meet standards across all industrial sectors, especially in the lead-up to 2021 – the year which marks the first of China’s “two centenary goals” which represent the 100th anniversaries of both the CCP and the People’s Republic of China – goals which were made by the 18th Party Congress in 2012, the same Party Congress that saw Xi Jinping assume his leadership position. A new round of environmental inspections was confirmed this October and China will soon begin dispatching teams of inspectors in the coming months.

Roskill’s research in China suggests that the government believes environmental protection will improve economic development. Many Chinese companies in the refractories supply chains are reporting higher profits since environmental inspections improved their processes, especially at the loss-making state-owned enterprises (SOEs). Roskill’s in-house forecasts expect Chinese crude steel production to remain flat between 2019 and 2021 at around 975Mt before declining by 0.6%py to 2029. World crude steel is expected to see growth of just 0.8%py between 2019 and 2029, resulting in a flat forecast for concomitant global refractory output.

Roskill’s NEW report Non-metallurgical Bauxite & Alumina: Outlook to 2029, 10th edition is due for publication soon. Click here to download the brochure and sample pages, or to access further information. Roskill also publishes a range of reports covering the graphite and magnesia markets.

Related News